Blog

- Details

As we are now half way through 2025, it's certain the Wolverhampton housing market has been more restrained than the post pandemic 24 months of summer 2020 through to July/August of 2022, and I believe that the ‘steady as she goes’ outlook will continue into the rest of 2025 and beyond.

As we always say in our Wolverhampton property market updates, home ownership is a medium to long-term investment, so we feel it’s always important to measure what has happened to Wolverhampton house prices over those medium to long terms.

Since the summer of 2005 the average Wolverhampton homeowner has

seen their property’s value rise by an average of 47%.

This is significant as house prices are a national fascination and sub-consciously tied into the perceived health of the UK economy. Most of that 47% gain has come from the overall growth in all Wolverhampton property values, while some of it will have come about by modernising, extending or developing their Wolverhampton home.

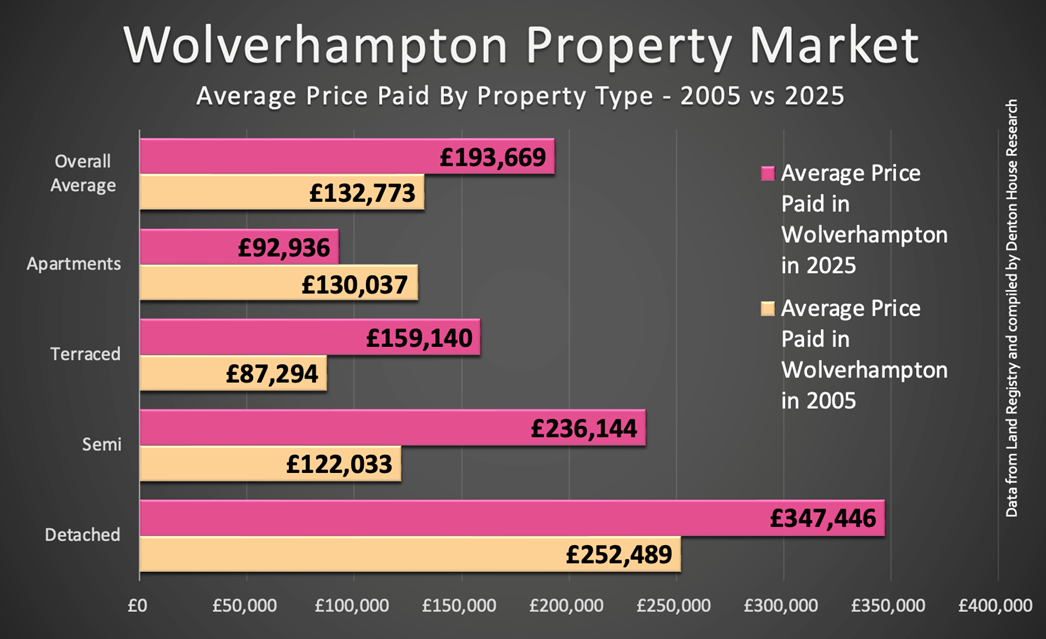

Analysing the different types of property in Wolverhampton and the profit made by each type, it makes interesting reading:

- Overall average for all homes in Wolverhampton. The average price paid for all homes in Wolverhampton in 2005 was £132,773. Now it's 2025, and it has risen to £193,669. This is a total profit of £60,896 (which is £3,045 profit per year per home or an annual growth of 2.4% per year).

- Apartments in Wolverhampton. The average price paid for apartments in Wolverhampton in 2005 was £130,037. Now it's 2025, and it has fallen to £92,936. This is a total loss of £37,101 (which is £1,855 loss per year per home or an annual loss of -1.4% per year).

- Terraced/Town Houses in Wolverhampton. The average price paid for all town house/terraced houses in Wolverhampton in 2005 was £87,294. Now it's 2025, and it has risen to £159,140. This is a total profit of £71,846 (which is £3,592 profit per year per home or an annual growth of 4.1% per year).

- Semi-Detached Homes in Wolverhampton. The average price paid for all semis in Wolverhampton in 2005 was £122,033. Now it's 2025, and it has risen to £236,144. This is a total profit of £114,111 (which is £5,706 profit per year per home or an annual growth of 4.7% per year).

- Detached Homes in Wolverhampton. The average price paid for all detached homes in Wolverhampton in 2005 was £252,489. Now it's 2025, and it has risen to £347,446. This is a total profit of £94,957 (which is £4,748 profit per year per home or an annual growth of 1.9% per year).

However, we can’t forget there has been 77% inflation over those 20 years, which eats into the ‘real’ value (or true spending power of that profit) … so if we consider inflation since 2005, the true ‘spending power’ of that profit has been lower.

- Overall average for all homes in Wolverhampton. The total 'real profit' (i.e. after inflation has been deducted) for the average Wolverhampton home is £34,366 for the last 20 years. This equates to £1,718 'real' profit per annum.

- Wolverhampton Terraced/Town House homes. The total 'real profit' (i.e. after inflation has been deducted) for the average Wolverhampton town house/terraced home is £40,545 for the last 20 years. This equates to £2,027 'real' profit per annum.

- Wolverhampton Semi-Detached homes. The total 'real profit' (i.e. after inflation has been deducted) for the average Wolverhampton semi-detached home is £64,397 for the last 20 years. This equates to £3,220 'real' profit per annum.

- Wolverhampton Detached homes. The total 'real profit' (i.e. after inflation has been removed) for the average Wolverhampton detached home is £53,587 for the last 20 years. This equates to £2,679 'real' profit per annum.

Therefore, the profit for an average Wolverhampton home over the last two decades, adjusted for inflation, stands at £1,718 per year.

We wanted to show you that despite the 2008/09 Credit Crunch property market crash, which saw Wolverhampton property values plummet by 16% to 19% over 18 months, Wolverhampton homeowners have still fared better over the long term than those renting.

Looking ahead, a common question I get asked is about the future

direction of the Wolverhampton property market.

The main influence on maintaining house price growth in Wolverhampton over the medium to long term will be the construction of new homes (on the supply side) and employment and interest rates (on the demand side). Although we have yet to get the official figures for 2024, independent sources indicate that the number of new households is expected to be around 217,900. Bearing in mind the annual need is for 300,000 new UK households to meet demands - arising from factors such as increased life expectancy, immigration, and later cohabitation - it’s clear that demand will continue to exceed supply unless the government heavily builds council houses.

This can only be good news for Wolverhampton homeowners.

What about Wolverhampton landlords, though?

Even though the quantity of landlords selling up their rental portfolios has increased in the last couple of years and the number of landlords purchasing buy-to-let properties is lower than in the last couple of decades, there is still margin net growth in the size of the private rented sector each year. This is all notwithstanding landlords facing higher taxes. The fact is many Wolverhampton landlords continue to be keen on expanding their rental portfolios in the medium to long term.

Many of the 20 and 30 something’s of Wolverhampton view renting as a choice that offers flexibility and options that homeownership does not provide. This means that demand for rentals will keep rising, allowing landlords to enjoy capital appreciation and rising rents. However, Wolverhampton buy-to-let landlords must accept more considerate strategies to maintain profitable returns from their investments.

As a Wolverhampton buy-to-let landlord, the issue for you is how to

ensure this growth continues.

Up until 2017, generating profits from buy-to-let property investments was like falling off a log. Since then, with changes in legislation and taxation, the balance of power, achieving similar returns will be more effortful. Over the past 8 years, we have observed the evolution of agents from mere rent collectors to tactical rental portfolio managers. We, along with a select number of agents in Wolverhampton, are skilful at providing strategic and comprehensive portfolio leadership. This service offers a structured overview of your investment goals across short, medium and long-term horizons, focusing on your expected returns, yields and capital growth. If you seek such advice, feel free to contact your current agent or us directly at no cost or obligation.

- Details

In early 2023, most property forecasters anticipated a significant downturn in the UK housing market over the following two years. Halifax predicted an 8% drop in house prices, Savills went further at 10%, and Nomura Bank predicted a fall of up to 15%. While these gloomy forecasts grabbed headlines, the actual data told a different story. According to the Land Registry…

UK house prices are 1.76% higher today than in January 2023, and Wolverhampton house prices are 4.14% higher.

Now, as we are halfway through 2025, many are asking the same question again: will house prices crash this year? Based on current data and trends, the answer is no.

The first thing to note is that although there have been some slight dips in the national averages in early 2025, the falls have been modest. Nationwide reported a 0.8% drop in June (the most significant monthly dip in two years), and the Land Registry figures for April showed a 2.8% annual fall. However, this needs to be put into context. These figures follow a period of exceptional growth during the pandemic years; one shouldn’t expect the market to collapse, and it is now normalising rather than collapsing. Rightmove, which tracks asking prices rather than completed sales, reported a 0.3% drop in June, citing an increase in supply and fading of the stamp duty boost.

Also, Denton House Research uniquely track the £/sq.ft figures at the sale agreed date in the UK. The £/sq.ft figures track the Land Registry five months in advance with a 98% correlation. This means we know what will happen to the published Land Registry house prices five months in advance with a very high level of certainty. Five months ago, the pound per square foot for UK home sales agreed was at £338.67, and today it stands at £346.25 per square foot. Therefore, based on this calculation, UK house prices should be 2.24% higher by January than they are today. None of these points point to a crash.

Looking at the total number of property sales in Wolverhampton…

In the first six months of 2024, 1,509 Wolverhampton homes were sold subject to contract. In 2025, the figure climbed to 1,597 ... a sign of growing confidence in the market.

Wolverhampton – WV1/2/3/4/6/10/11.

In fact, at the start of the year, most forecasters expected prices to rise moderately this year. Savills and the HomeOwners Alliance both project growth of around 4% in 2025. Zoopla has forecast a more cautious 2.5% rise, and Knight Frank predicts a similar increase. Capital Economics anticipated average house price growth of around 4% per year between 2025 and 2027. The consensus across the industry is for stability or a modest recovery, rather than a dramatic decline.

A key reason for the relative resilience of Wolverhampton house prices is the low mortgage rates.

After climbing to over 6% in 2023, rates have stabilised and are expected to continue to fall gradually through 2025. Many lenders have already dropped their fixed-rate deals below 4.5%, and further reductions are likely if the Bank of England continue to cut its base rate later in the year. This shift in affordability is expected to improve buyer sentiment and support price levels.

Crucially, the UK labour market remains strong. Unemployment is low, currently sitting at around 4.6%, and wage growth is holding steady at 5.2% per year. This means that most households can manage their mortgage payments, even with higher interest rates. There is little sign of the kind of financial stress that forces mass sales or repossessions, which typically precede major house price crashes.

Another critical factor is the increasing regulation of mortgage lending over the past decade. Since the introduction of the Mortgage Market Review in 2014, borrowers have had to demonstrate that they can afford repayments at interest rates significantly higher than those they are currently paying. This stress testing was designed to create market resilience, and it has been effective. Even at the height of ultra-low rates, new borrowers had to demonstrate that they could afford repayments of 6.5% or 7%. Now that rates have risen, most are already well-equipped to manage the change. The average stress test rate in 2024 was 7.5% to 8%, and borrowers continue to pass these checks.

There’s also more balance in the Wolverhampton property market.

There has been a rise in the number of Wolverhampton homes for sale with 1,090 available today, up from 1,068 in July 2023. Meanwhile, buyer enquiries have also increased.

Wolverhampton city centre + 3 miles.

This subtle increase in the supply of Wolverhampton homes on the market offers Wolverhampton buyers more choice and has helped prevent bidding wars that inflate prices. Yet demand remains strong, supported by population growth, longer life expectancy, lifestyle changes, and the ongoing desire for homeownership. This equilibrium of supply and demand is stabilising prices, not sending them into freefall. You see, one of the main reasons UK house prices dropped in late 2007 was the high level of homes on the market. In July 2007, there were 2,413 homes for sale in Wolverhampton!

Meanwhile, the rental market is adding another layer of support. High rents have prompted many tenants to consider buying as a more cost-effective long-term option. This has boosted first-time buyer numbers, especially in areas where house prices remain relatively affordable, like Wolverhampton. Some Wolverhampton landlords are also exiting the market, which reduces rental stock, drives up rents further, and makes buying more appealing.

Of course, there are variations across the UK. Some parts of London and the South have seen a softening in house prices over the last few years, as affordability pressures and changes to stamp duty and landlord taxation have taken a greater toll. However, many regions, particularly those in the North of England, Northern Ireland, and parts of Scotland, continue to experience modest house price growth. Regional disparities will always exist, but they don't change the national picture, which is one of moderation, not meltdown.

Could a house price crash still occur?

It's not impossible, but the necessary conditions are not present. To see a genuine crash, we would need a perfect storm: a sharp rise in unemployment, a sudden spike in interest rates, a collapse in mortgage availability, and a wave of forced sales. None of those elements is currently on the horizon.

Even the risks that do exist, i.e. slower-than-expected rate cuts, changes to government housing policy, or economic shocks from abroad, would likely lead to stagnation or small dips, rather than a crash. The foundation of the UK housing market is far stronger than it was in 2008 or the late 1980’s. There is no subprime mortgage crisis, no rampant overborrowing, and no glut of unsold new builds.

In conclusion, although the UK housing market in 2025 is not without its challenges, the data and trends indicate a firm direction towards stability. A crash remains highly unlikely. Most regions are expected to experience slow but steady growth. Some pricier areas may dip slightly. But overall, the narrative for 2025 is one of cautious optimism. Buyers and sellers alike would do well to tune out the crash headlines and focus on what the numbers are saying.

If you're planning to move, buy, or invest this year, opportunities abound, especially if you understand your local market and take a long-term perspective. This is a normalising market, not a collapsing one.

- Details

If you have ever thought about selling your Wolverhampton home, chances are you have been tempted to push the asking price a little higher than advised. After all, it’s your biggest tax free asset. A few extra thousand on the asking price of your Wolverhampton home sounds like a smart move, doesn’t it?

But here’s the rub: in property, chasing too much can often mean getting nothing at all.

Since the start of 2020, over 6,386 homes, listed for sale in Wolverhampton were withdrawn from the market unsold. And while some may blame timing or market conditions, in many cases the underlying problem is much simpler, the asking price was too high from the outset.

Let us explore how this has unfolded, why it’s happening, and most importantly, what you can do as a Wolverhampton homeowner to avoid falling into the same trap.

The Temptation to Overprice and Why it Backfires

When estate agents come round to pitch for your business, it’s not uncommon to hear different figures. One might suggest £285,000. Another £300,000. Then someone walks in and says £325,000, no hesitation, no caveats.

It’s flattering. It’s exciting. And it’s often a trap.

Some agents know exactly what figure will win your instruction, even if it has little grounding in what the market will pay. They don’t need to sell the home straight away they just need it on the books.

The Wolverhampton Numbers Don’t Lie

Let’s look at the hard data for the WV1-4, WV6, WV10 and WV11 postcode districts. Of the homes that left Wolverhampton estate agents’ books, what percentage of them withdrew from the market without selling?

2020

- Of the 3,602 Wolverhampton homes that came off agent's books:

- 2,349 of them sold & exchanged contracts (i.e. the homeowners moved),

- and the remaining 1,253 of them didn’t sell (i.e. 34.8% failed to move home).

2021

- Of the 3,885 Wolverhampton homes that came off agent's books:

- 2,792 of them sold & exchanged contracts,

- and the remaining 1,093 of them didn’t sell (i.e. 28.1% failed to move home).

2022

- Of the 3,384 Wolverhampton homes that came off agent's books:

- 2,467 of them sold & exchanged contracts,

- and the remaining 917 of them didn’t sell (i.e. 27.1% failed to move home).

2023

- Of the 3,501 Wolverhampton homes that came off agent's books:

- 2,185 of them sold & exchanged contracts,

- and the remaining 1,316 of them didn’t sell (i.e. 37.6% failed to move home).

2024

- Of the 3,679 Wolverhampton homes that came off agent's books:

- 2,368 of them sold & exchanged contracts,

- and the remaining 1,311 of them didn’t sell (i.e. 35.6% failed to move home).

2025 YTD

- Of the 1,487 Wolverhampton homes that came off agent's books:

- 991 of them sold & exchanged contracts,

- and the remaining 496 of them didn’t sell (i.e. 33.4% failed to move home).

In total, that’s 6,386 homes in Wolverhampton since January 2020 that came to market yet never sold. Most of those were overvalued and withdrawn in frustration. Nearly all were likely overpriced in comparison to what buyers were willing to pay at the time.

This is not a coincidence. It’s a pattern.

- Details

Let us play devil’s advocate for a moment.

We’re told that giving buyers everything up front — floorplans, video tours, drone footage, high-res images of every corner, right down to the boiler cupboard — is the way forward. “Transparency!” they say. “Efficiency! Convenience!”

But here’s the uncomfortable question no one seems to be asking:

Is showing absolutely everything online actually putting people off?

Because in 5 decades of selling homes, one thing’s remained absolutely true — people don’t buy with their heads. They buy with their hearts.

Too Much Info, Not Enough Imagination

Let’s be honest. When you give buyers 40 photos, a video walkthrough, a floorplan, a plot map, and a virtual tour, what do they do?

They sit at home and pick holes in it.

“The lounge is a bit narrow.”

“Not sure about the tiles in the kitchen.”

“Garden looks like it slopes a bit.”

“All the bedrooms are on the small side.”

“Oh, and there’s no pantry.”

And just like that, they swipe past a home they might have fallen in love with if they’d only stepped through the front door.

Are we creating a generation of home-buyers who are filtering out the “maybes” before their feet ever hit a hallway. It’s like online dating — too many filters, and you’re left single at 50 wondering why you said no to someone because they didn’t like dogs or listed “jazz” as a hobby.

Homes Aren’t Bought on Paper

Here’s the truth: most people end up buying a house that wasn’t exactly what they were looking for. It didn’t tick every box on the wish list. It wasn’t always in the perfect location. But it felt right.

It had that something — the light through the kitchen window, the way the garden felt private, or the fact that their toddler made a beeline for the under-stairs cupboard and called it “his den.”

You can’t capture that in a JPEG. You can’t bottle it in a floorplan.

And when buyers only judge a property from a phone screen, they miss the magic. The feeling. The potential. The human side of the process.

But What About Investors?

Of course, investors are a different beast. They want numbers, not nostalgia. Floor area, rental yield, roof condition. Show them the EPC and a spreadsheet, and they’re off.

But the average buyer — the couple looking for their first home, the growing family moving up the ladder, the retired couple looking to downsize — they’re buying with their gut. Not a calculator.

And maybe, just maybe, we’re making it too easy for them to say “no” before they’ve even had a chance to say “hmm… maybe.”

So What’s the Answer?

We’re not saying we should go back to one photo and a vague description that reads “three-bed, must be seen.” We’ve come too far for that.

But maybe we need to leave a little to the imagination. Maybe we don’t need 36 photos of the ensuite. Maybe we could give just enough information to spark curiosity — not kill it.

Because the goal isn’t to get someone to see a house.

The goal is to get them to feel something about it.

And that still happens best when they walk through the door, smell the fresh coffee (or the slightly overenthusiastic plug-in), and see themselves living there.

Not just when they’re scrolling on the loo.

- Details

Over the past five years, Wolverhampton's private rental market has experienced a significant growth in rents. The average monthly rent has increased from £676 in 2020 to £1,050 in 2025, representing a 55% rise.

These local trends are interesting when compared with the national picture, where the average monthly rent increased from £1,331 in 2020 to £1,803 in 2025, a rise of 35%. Regionally, in the West Midlands, the rent rose from £808 to £1,087, a 34% increase.

Yet, as affordability tightens, some landlords who were too optimistic with their pricing have been forced to reduce their asking rents; 24% of rental listings across the UK experienced price adjustments in 2025 alone. Despite this, tenants in Wolverhampton are now paying substantially more than they were just five years ago.

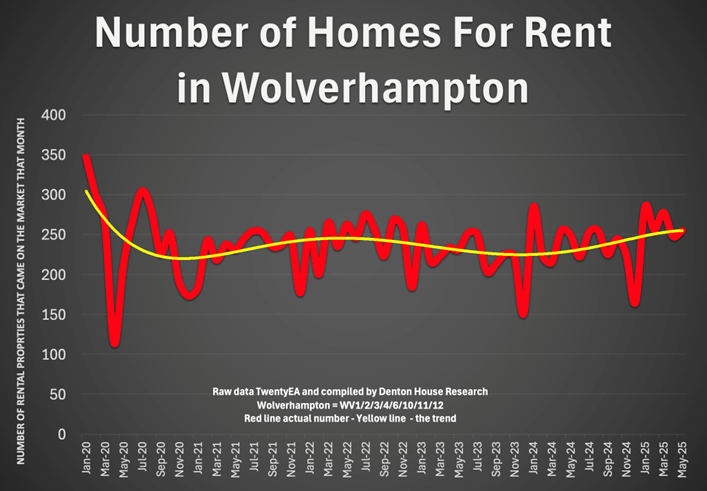

Next, let’s look at the supply of rental properties in Wolverhampton over the last five years. Even though the level of rental listings coming onto the market has increased (which bucks the national trend), demand has still outstripped supply as rents have increased.

- Wolverhampton averaged new rental listings each month in 2020 - 245

- Wolverhampton averaged new rental listings each month in 2021 - 230

- Wolverhampton averaged new rental listings each month in 2022 - 244

- Wolverhampton averaged new rental listings each month in 2023 - 224

- Wolverhampton averaged new rental listings each month in 2024 - 235

- Wolverhampton averaged new rental listings each month in 2025 - 264

Seasonal trends are also notable. Rental supply tends to peak in late spring and early autumn, with October being particularly strong (because of the student market), while winter months, especially December, show the lowest levels. This cyclical pattern was disrupted during the pandemic but has since resumed, albeit with generally lower volumes.

The current imbalance of limited supply and high demand has tightened the market. Nationally, rental availability remains more than 25% below pre-pandemic levels.

In Wolverhampton, agents continue to report strong tenant demand, though the frenzy seen in 2022 and 2023 has calmed somewhat. Listings still attract multiple enquiries, particularly due to the city’s affordability relative to nearby towns and other cities. Low vacancy rates persist, and while the supply/demand gap may be narrowing slightly, it remains significant.

Analysts estimate that 50,000 more rental homes are needed nationwide each year to restore pre-2020 availability. Until that gap closes, upward pressure on rents in citys like Wolverhampton is likely to continue. While the scale of rental increases is expected to moderate compared to previous years, I am forecasting a further 3% to 4% rental growth in 2025.