Blog

- Details

Understanding what’s really going on in the Wolverhampton property market is key to cutting through the noise and seeing the true picture—both locally and nationally. Despite the near constant doom and gloom headlines predicting a housing crash since September 2022, the stats tell a very different story. The British property market—and Wolverhampton in particular—is holding up remarkedly well.

So, let’s investigate those property market stats, starting with the life blood of the housing market—new properties coming on to the market.

- Details

In today’s Wolverhampton property market, the Bank of Mum and Dad remains a powerful force — and it’s only grown more influential. For many first-time buyers in Wolverhampton, parental help is not just a boost, it’s often the key to the front door.

But is this a sign of generosity? Or a symptom of something much deeper going on in our housing system?

In Wolverhampton (WV1-4/6/10/11), the bank of Mum and Dad has given £8,902,333 in deposit contributions in the last 12 months alone to Wolverhampton first-time buyers.

The typical Wolverhampton first-time buyer property now costs £180,900 and although the lenders still only ask for a minimum deposit of 5%, the average deposit is just over 16%.

That means many Wolverhampton buyers are coming up with an average deposit of £29,306. A sizeable £12,821 of that is being provided by parents (The Bank of Mum and Dad).

While help from family is undeniably valuable and often given with love, it’s also created a divide. Those lucky enough to receive support are moving forward, while those without it are left wondering if they'll ever own a home.

Over half of first-time buyers under 35 across the UK now rely on parental help in some form. And it’s not just lump sums anymore. Some parents are leveraging their own homes to springboard their children into property ownership. Others are going in on joint mortgages or acting as guarantors. The routes are varied — but they all rely on one thing: having access to wealth in the first place.

This growing reliance on family wealth to secure housing has led one commentator (Eliza Filby) to coin the phrase ‘inheritocracy’. It's the idea that life milestones — from getting on the property ladder to starting a family — are increasingly determined not by what you earn or learn, but by what you inherit. Or, more often these days, what you’re gifted early.

Now, before we get too misty eyed about the good old days, it’s worth remembering that the average first-time buyer age is now 34 nationally (it’s been between 32 and 34 years old since the millennium). And it’s no wonder: wages haven’t kept up with house prices, rent is eating into savings, and deposits are higher than ever.

For many, the Bank of Mum and Dad isn’t a nice-to-have,

it’s the only route to buying a Wolverhampton home.

But here’s the thing: you don’t have to have wealthy parents to buy a home. It might feel that way, especially when headlines are full of six-figure gifts and inheritance windfalls. Yet there are still 95% mortgages available, and a growing number of lenders are reintroducing innovative products like springboard and family offset mortgages. Some local building societies and high street names are even offering 100% loans in specific circumstances.

Schemes like shared ownership and Lifetime ISAs continue to support those who are prepared to think differently. And even the government stamp duty relief for first-time buyers has dropped from £425,000 to £300,000, that is better than second time buyers stamp duty threshold and still provides a leg-up for many.

Yet at the same time, the Wolverhampton rental

market has seen a shift in sentiment.

Increasingly, renting isn’t viewed as a failure, but as a flexible lifestyle choice. Some younger Wolverhampton residents are opting to rent longer while focusing on careers, saving strategically, or even planning to inherit in later life. The stigma is fading.

There’s a cultural shift underway too. More and more young people are openly acknowledging the support they've had. But others — those without parental help — are voicing growing frustration at what they see as an uneven playing field. We’re not just talking about a gap between generations anymore. We’re talking about gaps within generations.

In this context, it’s clear that the Bank of Mum and Dad is both a lifeline and a lightning rod. It helps people buy homes, yes. But it also reinforces wealth divides. That’s not a criticism of those who give or receive help — it’s simply the reality of a system where property ownership is increasingly out of reach without it.

As a local Wolverhampton estate agent, we see the joy that buying a home brings and we understand the pressures families feel to provide that step up. But we also see the quiet resilience of those buyers doing it alone, scraping together deposits, working multiple jobs, and thinking creatively to make homeownership happen.

So, what’s the takeaway here in Wolverhampton?

If you’re a Wolverhampton parent with the means to help, you’re not alone. But before gifting a deposit, have the tough conversations. Is it a gift or a loan? What are the expectations? Will it affect your retirement or your care needs in later life?

If you’re a buyer without family support, don’t lose hope. Explore every scheme. Look into chatting with the banks and building societies. Talk to mortgage brokers. Ask your estate agent questions. There are still paths to ownership.

And if you’re a policymaker? Perhaps the focus needs to shift from helping people buy, to helping build. More homes, more variety, more affordability. That’s the long-term solution.

In the meantime, the Bank of Mum and Dad continues to be the quiet partner in many Wolverhampton property deals. But let’s not mistake it for a fix. It’s a workaround — a generous one, yes, but still a workaround.

And one that speaks volumes about the state of our housing market in 2025.

- Details

Why Do New Builds Cost More?

At first glance, the price difference between a new build home and an existing property might seem to be down to personal preference. Some buyers (and tenants) prefer a new home's fresh, modern feel, while others favour the character and reliability of a property that has stood the test of time. But is there more to it than taste?

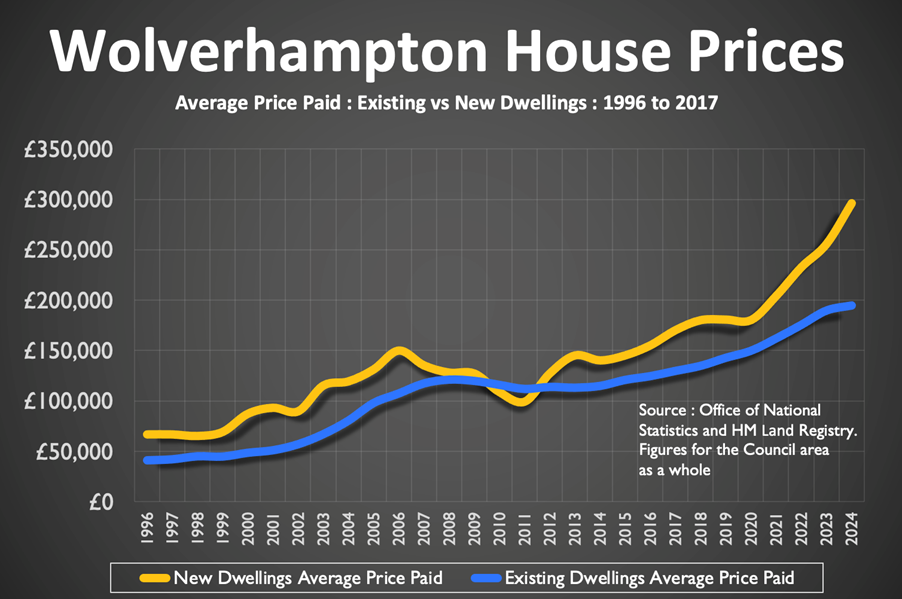

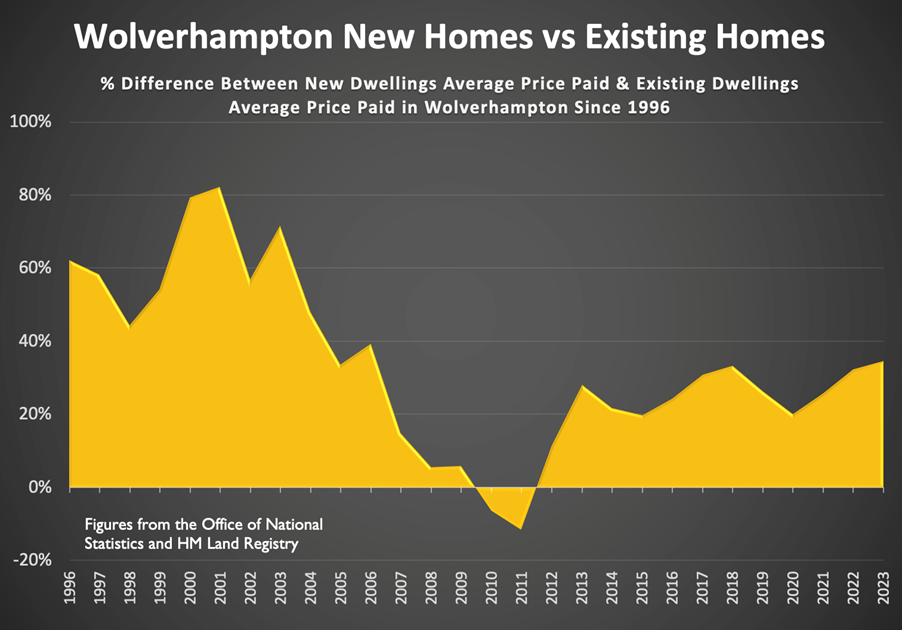

Looking at the average price paid for existing (second-hand) homes versus new build properties in Wolverhampton since 1996, a clear trend emerges: new build homes command a significant premium.

- Between 1996 and 2008, the average newly built home sold for £30,231 more than an existing Wolverhampton home.

- Yet, between 2008 and 2013, the average newly built home sold for £7,185 less than an existing Wolverhampton home.

- Since 2013, the average newly built home has sold for £44,039 more than an existing Wolverhampton home.

Over the past 29 years, the average ‘new build premium’—the additional amount buyers pay for a newly built home compared to a second-hand one—has been 35.2%. However, if we look at the last 10 years, that is 29.9%.

The ‘new build premium’ refers to the additional price buyers pay for a newly constructed home compared to a similar second-hand property. Factors such as modern design, energy efficiency, and developer incentives contribute to this price gap. However, the premium fluctuates with market conditions—rising in a strong market when demand is high and shrinking in tougher times when buyers have more negotiating power. Understanding this trend can help buyers and investors make more informed decisions about when and what to buy.

The Numbers Behind the Premium

Using the latest data up to the end of 2023, the difference in the average price paid for a new home versus the average price paid for an existing home continues to highlight a consistent premium. Overall, it’s my experience that the premium for new detached and semi-detached homes is in the order of 10% to 20%, while apartments can be much higher than that. As always, there are exceptions to the rule.

Why Do Buyers Pay More for a New Build?

Many buyers are willing to pay a premium for a new build, despite the perception that they are overpriced. One key reason is personalisation—new homes can be tailored to suit individual needs, lifestyles, and furniture choices. Additionally, they require less maintenance than older properties and often come with a builder’s guarantee, providing peace of mind against unexpected issues. With no need for immediate refurbishment or repainting, moving in is a hassle-free experience.

Another major factor is energy efficiency. Older homes tend to have poor insulation and higher running costs, whereas modern builds are designed to be more energy-efficient, helping to reduce household bills. In recent years, as energy costs have risen, efficiency has become a top priority for many buyers, alongside location and lifestyle.

The Property Market Factor: Boom vs. Bust

One of the most revealing insights from the data is how the ‘new build premium’ fluctuates with the property market cycle:

- In a strong, buoyant market, the premium tends to increase as buyers compete for new stock, and developers’ prices increase accordingly.

- The premium shrinks in a slower, more challenging market, offering better value for those looking to buy new.

- Nationally, the premium was higher before the global financial crash (2008/9) compared to afterwards.

This means that if budget is the primary concern, timing is crucial. Purchasing a newly built home in a softer market could be a smarter financial move than in a property boom.

The Reality of Comparing Like for Like Homes

It’s important to acknowledge that comparing new build and second-hand Wolverhampton homes isn't always straightforward. Unlike cars, where a brand-new vehicle and a low-mileage second-hand version can be directly compared, housing has more variables at play—location, build quality, developer reputation, and even incentives like part exchange or stamp duty contributions.

By their very nature, the type of Wolverhampton homes that have been built as brand new homes in one year could be completely different from the existing Wolverhampton homes that are being sold. Also, for every new home sold in a year, the number of existing homes is in the region of five to seven depending on the location.

Therefore, a perfect like for like comparison would require identical properties, side by side, in the same condition—a scenario that rarely exists. This complexity means that while the premium is a useful benchmark, it should be taken with a pinch of salt and your individual circumstances always play a role.

Final Thoughts

Should you pay the premium for a new build? It depends on your priorities. The extra cost might be worth it if you value a pristine Wolverhampton home with the latest design and efficiency standards. However, if maximising value is your goal, buying second hand—or timing your purchase of a brand new home in a weaker market—could be the better move.

- Details

The Government has taken a significant step towards abolishing leasehold properties in England and Wales, introducing a white paper that proposes making commonhold the default tenure for flats and apartments. The reforms, which aim to phase out leasehold for the 4,006,038 English & Welsh leasehold homes, have been described as the "beginning of the end" for a system often criticised as outdated and unfair. But what does this mean for Wolverhampton homeowners and buy-to-let landlords, particularly those looking to sell in the coming years?

In this article, we’ll explore the proposed changes, the benefits and drawbacks of commonhold, and what Wolverhampton flat owners should consider as the transition unfolds.

- Details

Buying or selling a home is often one of the most significant transactions people make, yet the process in England and Wales remains frustratingly slow. You find the home of your dreams, you make an offer, it is negotiated, and a price is agreed. Yet once a sale is agreed, it takes an average of 118 days—nearly 17 weeks—for legal completion to take place for a home in the UK. That’s more than four months of uncertainty, stress, and potential financial risk for buyers and sellers alike.

To put that into perspective, the same process took just over 10 weeks in 2007 and 7 to 8 weeks in the 1990s. The delays have continued to worsen over time, making the system feel increasingly outdated in an era where digital solutions should be making things faster, not slower.

Also, don’t forget nearly 1 in 4 (23.94%) UK homes that have a sale agreed (Sold STC) fall through before legal exchange of contracts and completion on them.

The Key Causes of Delays

Several factors contribute to the sluggish pace of property transactions. Some of these issues are systemic, while others stem from choices made by buyers, sellers, or their representatives. Understanding them is the first step to minimising delays.

- The Outdated Conveyancing Process

The legal process of transferring ownership—conveyancing—remains one of the biggest obstacles. Unlike in Scotland, where much of the work is done before an offer is accepted, in England and Wales, the process only begins after a sale is agreed. This means vital information is often not gathered until weeks, or even months, into the process.

The time between pre-contract enquiries and receiving replies has more than doubled since 2007, rising from just under four weeks to nearly nine weeks. Despite improvements in technology, the process remains complex and fragmented, with no signs of timelines decreasing.

- Solicitor Workloads and Efficiency

The legal professionals handling transactions often work with high caseloads, balancing multiple sales at once. Many firms operate on tight margins, which leads to overworked conveyancers who can struggle to provide the level of service buyers and sellers expect. Delays in responding to enquiries or missing paperwork can add weeks to the process.

Mortgage processing times have also worsened. It now takes nearly nine weeks from instructing a conveyancer to receiving a mortgage offer—up from approximately five weeks in 2017.

- Chain Dependencies

Property chains remain one of the most fragile elements of the buying process. A single delay anywhere along the chain can ripple outward, derailing multiple transactions. When one party pulls out, the entire process collapses, forcing sellers and buyers to start again.

The average time for sales instruction to exchange has increased significantly, almost doubling from just over 10 weeks (71 days) in 2007 to nearly 17 weeks (118 days) today.

The lone bright spot for conveyancing is the search process, which has become more efficient, reducing from just over two weeks to approximately one and a half weeks. However, this is of little consolation when nearly every other part of the process has slowed down.

- Changing Market Conditions

Longer transaction times increase the risk that a buyer’s or seller’s circumstances change before completion. Mortgage offers expire, interest rates shift, job relocations happen—all of which can lead to deals falling apart. Gazumping (where a seller accepts a higher offer after initially agreeing to a sale) and gazundering (where a buyer lowers their offer at the last minute) are also far more likely in a drawn-out process.

How Long Does it Take to Do Sales Conveyancing in Wolverhampton?

Well before we answer that, it’s currently taking 78 days (just over 11 weeks) on average to find a buyer for a Wolverhampton home (national average is 74 days).

Once a sale is agreed, it takes 121 days in Wolverhampton to get a sale to completion.

Interestingly, when we look at the conveyancing depending on type of property, Wolverhampton flats are taking 131 days, Wolverhampton houses 119 days and Wolverhampton bungalows 134 days. These are all in line with national averages.

How to Speed Up the Sales Process

While structural reform of the system is long overdue, there are several steps buyers and sellers can take to reduce their own risk of getting stuck in limbo.

- Gather Information Upfront

Wolverhampton sellers can dramatically speed up the process by preparing key documents as they start to market their property. This includes:

- Ordering local authority searches from City of Wolverhampton Council when the home goes on the market.

- Completing your Property Information Form and Fixtures and Fittings List.

- Gathering any necessary guarantees, warranties, and building regulation approvals.

While this does involve a small upfront cost, it can prevent delays and strengthen a seller’s position, particularly if multiple buyers are interested.

- Choose a Proactive Wolverhampton Solicitor

Not all Wolverhampton solicitors operate at the same speed. Wolverhampton buyers and sellers should choose a legal professional based on efficiency, not just price. Online reviews and recommendations from experienced estate agents like me can be helpful in identifying firms that handle transactions efficiently and promptly.

A proactive solicitor who requests documents in advance, keeps communication clear, and follows up on outstanding tasks without being chased can shave weeks off the process. If you need the details of whom I consider the best solicitors for conveyancing in Wolverhampton, drop me a line.

- Tailor the Selling Strategy for your Wolverhampton home

Not all Wolverhampton homes should be sold in the same way. Traditional estate agency works well for most residential properties, but if speed is a priority, alternatives such as traditional auctions or the new ‘modern method of auction’ may be worth considering. Auction transactions complete much faster and eliminate the uncertainty of a long, drawn-out conveyancing process.

Sellers must weigh up whether achieving the highest possible price is worth months of additional holding costs, mortgage payments, and risk of fall-throughs.

Looking to the Future

The length of time it takes to buy and sell a home in Wolverhampton is a persistent problem, one that has worsened over the years. While there is no quick fix, those who take a proactive approach—by preparing early, choosing the right professionals, and considering alternative selling strategies—can significantly reduce the risk of delays and failed transactions.

Until wider reforms are introduced, taking control of the process is the best way to avoid months of uncertainty. Whether buying or selling, being prepared and making informed choices will always yield better results.

For those in Wolverhampton navigating the property market, local expertise and proactive planning can make all the difference in achieving a smooth and successful transaction. Feel free to call us and discuss the matters in this post without any obligation or cost.